Success Stories

We've helped many clients just like you. From business valuations to ERTC claims to realignment and recovery services, read some of our client success stories and case studies below.

Architecture · R&D Tax Credits

Architecture & Engineering Client Saves Over $500,000 with R&D Tax Credits

Read More

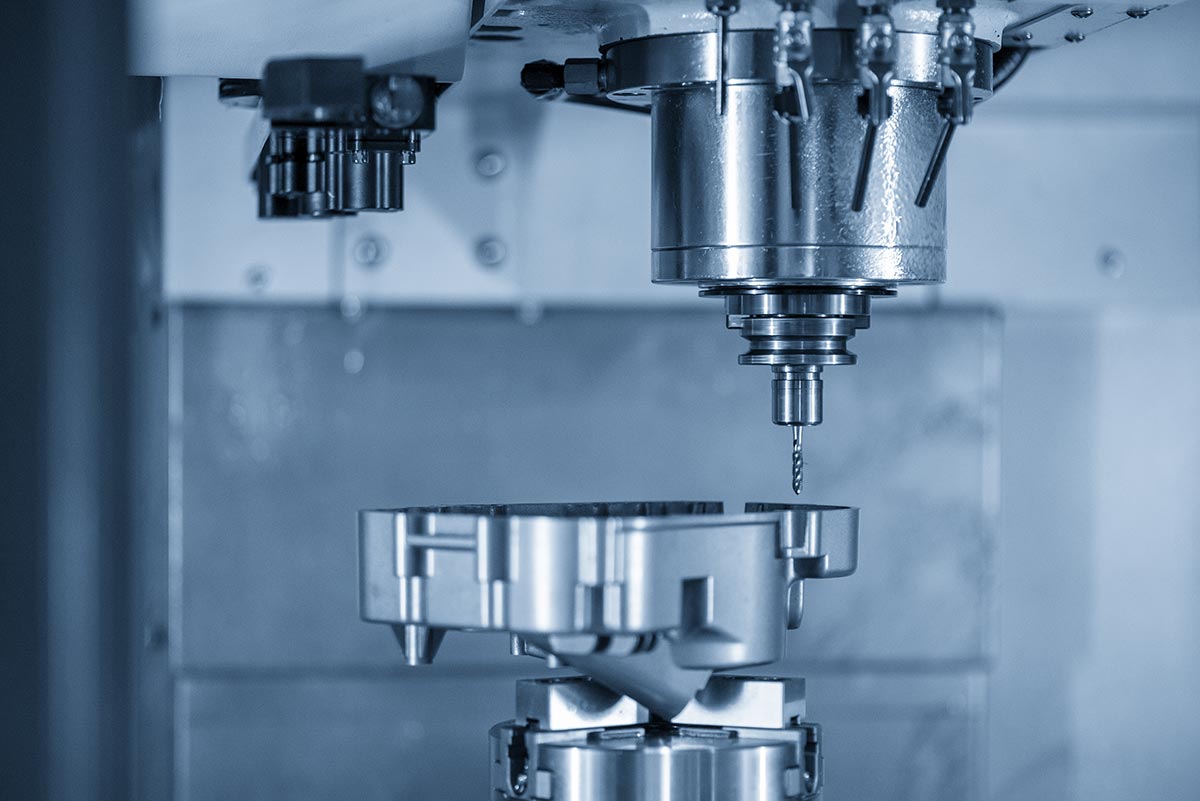

Manufacturing · R&D Tax Credits

Cunningham & Associates Saves Manufacturing Client Over 100,000 in Tax Credits

Read More

Construction · R&D Tax Credits

$30M General Contractor Identifies $240,000 in R&D Tax Credits

Read More

Architecture · R&D Tax Credits

Architecture & Engineering Client Gets 300,000 in R&D Tax Credits and a 10:1 ROI

Read More

Construction · R&D Tax Credits

Construction Development Client Saves $110,000 wiht R&D Tax Credits

Read More

Manufacturing · Consulting

Glass Company Receives Express Grant and Achieves Profitability

Read More

Manufacturing · Consulting

Specialty Manufacturer Saves $300,000 In Taxes and Grows Enterprise Value

Read More

Manufacturing · Tax Strategies

Strategic Tax Planning Nets Manufacturing Client $120,000 in Refunds

Read More

Manufacturing · R&D Tax Credits

Window Manufacturer Identifies $200,000+ Initial Savings with R&D Tax Credits

Read More

Manufacturing · R&D Tax Credits

Machine Shop Achieves $75,000+ Initial Tax Savings with R&D Tax Credits

Read More

Manufacturing · Consulting

Packaging Manufacturer Utilizes Grant and Boosts Sales By More Than 50%

Read More

Construction · R&D Tax Credits

Plumbing and Heating Contractor Saves Over $120,000 with R&D Tax Credits

Read MoreSorry, there are no results.

Have more questions?

Reach out to our team for a free consultation. Get all of your questions answered by certified tax professionals so you can achieve the best outcomes for your business.