Tax Strategies: R&D Credits

For businesses of all sizes, the IRS R&D tax credit offers an opportunity to lower your tax liability and increase savings. Learn more about R&D tax credits and speak with our team to see if you qualify.

Overview

What is the R&D tax credit?

The R&D (research and development) tax credit is a federal, and often state, tax incentive established to promote domestic innovation and production. For organizations of all sizes, from small startups to major corporations, this credit offers a dollar-for-dollar tax reduction for business operations including innovation, design, process improvement, and many other activities.

Significant savings are available for a range of qualifying activities; however, many businesses fail to claim the credit they are owed. In fact, only 1 in 20 eligible companies take advantage of it. Learn more about the R&D tax credit qualifications by checking out our FAQs.

Accelerate ROI

Lower Tax Liabilities

Reduce Tax Rate

Boost Earnings

Increase Cash Flow

Earn More Credit

How We Help

Explore your business R&D tax credit eligibility.

By partnering with the seasoned tax professionals at Cunningham & Associates, you can maximize savings for your businesses. We'll assess your qualifications for the credit and walk you through the application process if you meet eligibility requirements.

For most companies, the credit can be worth up to 7-10% on qualified research expenses. Don't leave any money on the table. Use our R&D tax credit calculator to find out how much you could receive.

Together, we'll maximize your incentives.

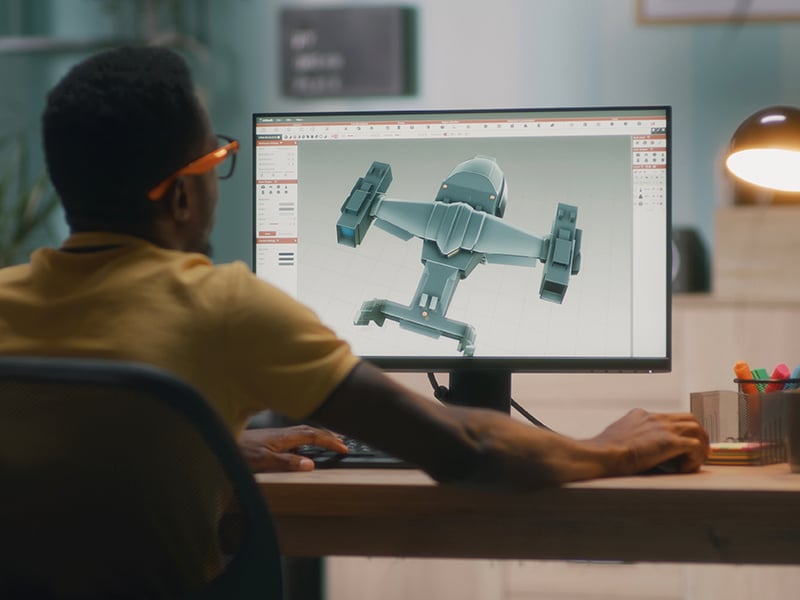

Drive innovation. Get rewarded for investing in your team and processes through innovation, design, and execution. When you qualify for the R&D credit, more money ends up back in your pockets to reinvest in your most successful ventures. Explore R&D tax credits in the plastics manufacturing industry.

Manage overhead costs. Equip your team with the knowledge to maximize their savings and reduce their tax liability. Together, we'll walk through the assessment and application process to reduce your overhead costs and deliver the best possible returns. Learn how to save your business thousands with R&D credits.

Plan for your future. Businesses of all sizes, across all industries, can take advantage of the R&D tax incentive. As soon as you receive your eligibility qualifications, you can begin to increase your cash flow and grow your business. Watch our latest videos to learn more about the R&D tax strategy.

Explore our step-by-step process.

Schedule a discovery call.

We get to know you, determine if we’re a fit, and go over the basic framework of R&D tax filing.

Complete a detailed executive summary.

We explore your individual case, analyze your financials, and consult the national database in accordance with all federal tax forms and national regulations set forth by the IRS.

Meet to discuss our findings.

We schedule a second call to review our findings and offer an outline to explain our procedure and next steps.

Finalize your tax filings.

We complete your filings in connection with our team of technical tax experts, conduct quality control, and sign on the dotted line as your licensed tax preparer before sending it off to the IRS.

What Our Clients Are Saying

"With Cunningham and Associates, you won’t just be in safe hands; you’ll save your money, too! Our company was looking to apply for R&D tax credits. A large national firm asked for a percentage-based fee, and honestly, it would have been a rip-off for us. These guys charged us a fixed fee and helped us unlock extra funds we weren’t even aware we had. We put that money back into our business, and we’re doing so much better than last year."

M.R.

"We first tried to handle our R&D tax credit application with a CPA and soon realized we needed help. At Cunningham and Associates, we were assigned a partner who not only gave us immediate attention but also guided us through the process so we knew exactly what was happening every step of the way."

M.K.

"As a manufacturing company, we were not sure if we would qualify for an R&D tax credit. We contacted Cunningham and Associates for a free audit, and they took over our case. They didn’t just fill out the paperwork for us; they made sure it was IRS-compliant and submitted on time. The communication was easy and stress-free. Thanks to them, we were able to get the funds we needed to reinvest in our business. They stand behind their work and take pride in helping clients. Highly recommend.”

R.R.

Find out if you qualify.

Do you qualify for the R&D tax credit? Speak with one of our certified tax professionals to explore your options and maximize your returns today.